Coinbase Exchange wallet

THE BASICS of EXCHANGE WALLETS

A cryptocurrency Exchange wallet is one which is usually offered by many cryptocurrency exchanges. A currency exchange is where you will probably buy some, if not all, of you currency using government-issued fiat currency – especially as a new currency holder. Most other wallet types you will read about later do not have this feature.

The exchange will typically offer to store your currency for you in their cryptocurrency Exchange wallet when you set up your account. This is a VERY convenient method to store your currency and will feel very much like a traditional bank account with a bill pay feature. In fact, typically, you will connect your bank details to your exchange account so you can easily buy and sell your coins.

The cryptocurrency Exchange wallet is basically an IOU indicating how much the Exchange owes you in coins if you ever want to sell them for fiat currency in the future, but it also allows you to send and receive coins to/from others for online purchases, etc. This type of wallet is also referred to as a Custodial wallet since the exchange keeps custody of all keys.

Any government-regulated exchange will require personal information about you, like one or more forms of government ID and banking details. If you want privacy then you might not want to use a regulated exchange. But if you want peace of mind that the exchange is doing things properly then a regulated exchange might be a good choice for you.

Click to jump to any section:

Table of Contents - Click to Open:

SECURITY of EXCHANGE WALLETS

To access your fund you will use a conventional password to log in to the Exchange wallet website. This means that there are no keys for you to lose. This type of wallet is considered less secure then the others you will read about because you are trusting the exchange to provide excellent security.

Unfortunately, as we have seen in the news, several exchanges have been hacked in the past few years. Hacked for 100’s of millions of dollars worth of cryptocurrency. Examples are the hack at Mt. Gox in 2014, and Bitfinex hack in 2016. And since all exchanges hold a vast wealth of cryptocurrency they are a very tempting target for crypto thieves. Most (but not all) exchanges have little or no insurance so don’t count on ever getting your money back. No matter whose fault the hack was.

Given the above drawbacks of a cryptocurrency Exchange wallet, a good exchange will take many countermeasures. For example, a “good” exchange will:

- 2FA: Offer to set up multi-factor authentication on your account so that you will need more than just a password to log in.

- COLD STORAGE: Keep the vast majority of their coins completely offline in what is called “cold storage”, such as putting the private keys in a bank vault.

- INSURANCE: Insure some, or all, of your assets. A regulated US exchange will insure up to $250,000 of your fiat cash in your exchange account. Some exchanges will also insure at least a portion of your cryptocurrency, but it will depend on who was a fault for the loss. If you exposed your personal password then there will be no coverage, but if it was a hack of the entire exchange, or employee misdeeds, then you will be covered. NO other type of wallet offers insurance. Example, see the Coinbase insurance coverage description.

- PROCEDURES: Have well-followed and detailed internal security procedures with very limited access to secure data and cold storage currency.

Often people who do choose a cryptocurrency Exchange wallet will move those coins into a private wallet. They will do so either immediately after purchase or when the value of their exchange account gets large enough to make them nervous about keeping it all in this less secure wallet.

Although most other wallet types are considered safer than an Exchange wallet, just remember that for all the ways that an Exchange wallet can get hacked there are also many ways that an individual can get hacked. And an uninformed beginner to the crypto world usually is unaware of all the various ways that this can happen and what they need to do to adequately protect their currency from theft.

So, depending on your knowledge and tech abilities it can actually be a toss-up as to which type is better for YOU. This is generally true of all the different types of wallets. If you don’t understand how your wallet of choice can lose your currency then you won’t know what to do to protect it. And even if you know, if you don’t follow best principles then no amount of security built into the wallet will save you.

Using a cryptocurrency Exchange wallet presents several extra drawbacks (which you are giving up for convenience):

- OWNERSHIP: You do not technically own the currency in their wallet because you do not have the private keys to control the currency. You only get a password, not private keys. Private keys are the only true measure of ownership. If your exchange goes out of business, or gets sued, or shut down by the government, then your money will often go with them. In most other wallet types you will own and control your private keys and so you will always have direct access to your funds.

- PRIVACY: Many exchanges keep records of exactly who you are, where you live, and how much cryptocurrency you own. Those records can be a tempting target for your government and lawyers if they want to tax you or sue you. Additionally, thieves will be able to figure out how much money you have and where you live.

- BACK UP / RECOVER – EXCHANGE

An exchange wallet doesn’t require any sort of backup (unlike most other types of wallets) since you are not in control of your own keys and so there is nothing to back up. Also, unlike many other types of wallets, if you forget your password you can call the Exchange and get your password reset. Most other wallet types have no centralized recovery.

Jump to TOC

FEATURE SUMMARY of EXCHANGE WALLETS

A cryptocurrency Exchange wallet doesn’t provide as many features as other wallets since an Exchange wallet operates in a very different manner. Here is a list of features that this type of wallet can and should provide – but not all wallets of this type have all these features.

- 2FA: “Two Factor (two-step) Authentication”. Requires password PLUS phone or emailed code for better account protection.

- FIAT PURCHASE: Allows you to purchase currency using your government fiat currency.

- PASSWORD RESET: Allows you to reset your password if you forget it.

These features are explained in more details here. [Summary of Important Wallet Features]

PROS / CONS of EXCHANGE WALLETS

The following pros and cons are generalizations of what makes this wallet type uniquely different from most other wallet types.

Pros:

- ANY DEVICE/OS: No special software to download – just use your web browser on your computer or phone.

- COLD STORAGE: A “good” exchange will keep a large majority of their currency in cold storage so you don’t have to.

- FIAT PURCHASE: Allows you to purchase currency using your government fiat currency.

- INSURANCE: Some exchanges provide insurance against various types of loss

- NO BACKUPS: You don’t have to back up any keys – just remember your password

- NO LOST KEYS: You can’t lose your keys (because you are not given keys – this is also a negative)

- PASSWORD RECOVERY: Relatively easy to reset your forgotten password

- PROFESSIONAL SECURITY: Exchanges know all the ins-and-outs of security and they might keep coins safer than an ill-informed new crypto user.

Cons:

- COURT SEIZURE: Courts can seize your currency if your or your wallet provider is subject to a lawsuit.

- KEY TRUST: Requires trust in a 3rd party to keep your keys safe and not go out of business.

- NO PRIVACY: Unlike other wallets types, many Exchanges know exactly who you are. Your name, address, phone number and can release these to your government if required to do so by law.

- PSEUDO-OWNERSHIP: You do not fully control your own currency because you are not given the private keys.

- THEFT TARGET: An exchange presents a huge and Juicy theft target

- TROUBLING HISTORY: History of big Exchange thefts (but all wallet types can be robbed)

Jump to TOC

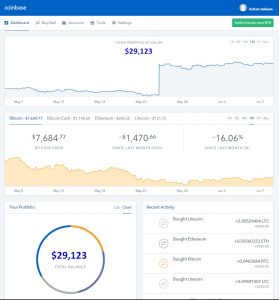

EXAMPLE of EXCHANGE WALLET

One example of a well regulated and insured cryptocurrency exchange wallet with a built-in cold storage feature and no history of theft is Coinbase.com.

Jump to TOC

GET STARTED of EXCHANGE WALLETS

To get started with this type of wallet you will first need to set up an account at cryptocurrency exchange which has a built-in wallet. A regulated exchange will usually require that you prove your identity. You can do this by providing them with a copy of one or more of your government-issued ID document. Then you may either send some fiat currency to this account so that you are ready to buy cryptocurrency at a moment’s notice, or you can do a direct transfer of funds from your bank when you are ready to purchase coins. It can take hours or days for your fund transfer to be available for use at the exchange. Some exchanges will also allow you to buy currency with your credit card – but not all credit card providers allow this. When you make your first purchase of currency then you can choose to have your currency held in the cryptocurrency Exchange wallet, or you can immediately send it to one of your other wallets.

DISCLAIMER: Although we have referenced the Coinbase exchange this does not mean that we are certifying that the exchange is safe to use. We only reference it because it is a well known and regulated exchange for this purpose. Do your own research, follow all security procedures, and use them at your own risk.

You can read about EVERY wallet types here.

Jump to TOC